long/short equity hedge fund

Outperforming the Market,

Engineered for Safety

Is your stock portfolio built for performance or just to ride the markets up and down?

PNTHR uses a modern, rules-based system that prioritizes performance over emotion and market noise. Every risk is deliberately managed to protect your capital.

AS SEEN ON

The PNTHR Strategy

Most fund managers don’t time well. We do. And that makes all the difference.

For illustration purposes only: In this example of Delta Airlines Stock from September 2023 through September 2024.

Most fund managers can’t time trades. And it costs their clients dearly. If you're current fund relies on a buy-and-hold "strategy", run!

When it comes to performance, TIMING IS EVERYTHING. And we’re among the best in the world at it.

Like the panther, we wait for the exact moment to strike. Our system is built to act with precision. It turns volatility into opportunity and emotion into discipline.

That’s how we protect capital and deliver real performance, cycle after cycle.

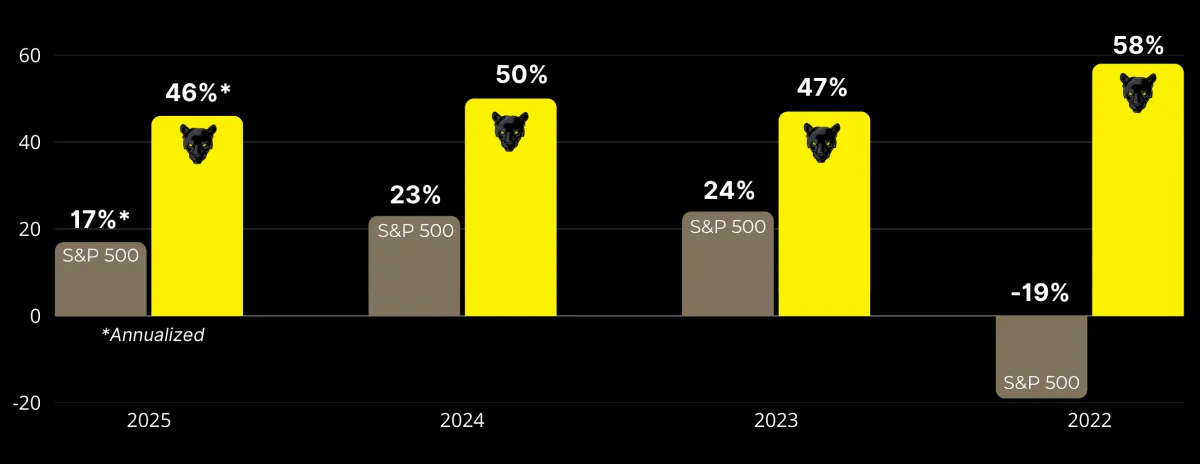

PNTHR Strategy Eats the Competition

This summary is based upon 3 years and 8 months of forward testing, generated live, using actual market data under real-world volatility (Jan 2022 - August 2025). The results include slippage, management and a blended performance fee (average of the three investment classes) for a $100,000 investment. While hypothetical and unaudited, were produced in a live environment to measure the system’s real-time decision-making capabilities. Past performance and recommendations of any principal are not a guarantee of future success.

What Drives Results

Is Also What Protects Your Capital

System, Not Speculation

Our strategy is rules-based and data-driven. No gut calls. No guesswork. Just disciplined execution built to perform.

Protection First, Always

Capital protection isn't an afterthought. It's built into our process from day one. Every position is risk-aware, and deliberately managed.

Profit Even When Markets Fall

We don’t just wait for bull markets. Our long/short strategy is built to find opportunity in both rising and falling conditions. Either way, you profit.

Strategic Capital Growth

This is disciplined investing with purpose. We help serious investors grow wealth using structure, clarity, and a proven plan.

Built for Accredited Investors

This is for you if...

Your 401(k) or IRA is on autopilot, but you know it could be working harder.

You want your capital managed with the same discipline you used to earn it.

You’re too busy to trade, but too smart to stay passive.

You question Wall Street narratives and advisor complacency.

You want real growth, without taking reckless risks.

Led by Experts.

Built for Results.

PNTHR is powered by a rare partnership: an expert investor with a proven edge, and a seasoned technologist who brings precision to every system. Together, they’ve built a fund that trades with discipline and operates with clarity.

Scott McBrien

Chief Investment Officer

A veteran investor with deep market expertise, Scott architects PNTHR’s rules-based long/short strategy. His approach is grounded in decades of research, refined execution, and real-time discipline.

Cindy Eagar

Chief Operations Officer

A seasoned tech leader and systems builder, Cindy ensures PNTHR runs with operational precision. She delivers institutional-grade reporting and a seamless investor experience.

PARTNERS

Professional Oversight at Every Layer

We’ve invested in the best third-party custodians, legal, compliance, and operational system. So you can invest with confidence.

Want to invest with retirement funds?

PNTHR is now approved through Madison Trust, so you can use your IRA or 401(k) to join the fund.

How It Works

We Manage a Long/Short Stock Strategy

Our rules-based system is designed to capture upside and limit downside using strict, repeatable logic that removes emotion from every investment decision.

You Allocate to Diversify, Grow and Protect

Most investors allocate 10 to 20 percent from their current portfolios. We can even help you use your existing 401(k) or IRA without tax penalties.

You See the Strategy at Work in Your Portfolio

You’ll get regular reports showing how your capital is performing. You stay informed and passive while we handle the execution.

CONTACT US

Address:

15150 W Park Place, Suite 215

Goodyear, AZ 85395

Email:

Phone:

+1 602-810-1940

COMPANY

LEGAL

This is a preliminary document that does not constitute an offer to sell nor the solicitation of an offer to buy any security. Such an offer may only be made pursuant to the Fund’s Confidential Private Placement Memorandum and related exhibits and enclosures (the PPM), which should be carefully reviewed. The information provided herein is qualified in its entirety by reference to the information, terms, risks and conditions presented in the PPM and the Fund’s investment strategies may vary in the future. This summary is for informational purposes only and is not an offer to provide any investment advisory services. The contents are based on information from sources believed to be reliable, but accuracy and completeness cannot be guaranteed and examples. Past performance and recommendations of any principal are not a guarantee of future success. This summary is being furnished on a confidential basis to a limited number of prospective investors who are both “qualified clients” or “qualified purchasers” and may not be used or reproduced for any purpose.

The results shared in this presentation are based on proprietary software that produces buy and sell signals that will be used by PNTHR FUNDS, Carnivore Quant Fund. The General Partner, The Investment Manager, and the Partnership are newly formed entities with no track record as an emerging hedge fund. However, the General Partner and Investment Manager have significant experience and history in the markets in various capacities and previously held NASD / FINRA securities licenses as identified in Section VII of the Private Placement Memorandum. Therefore, logically, as a newly formed entity, the Investment Manager, and the partnership have no audited financial statements, have no material history of operations or financial statements, and have no current experience as PNTHR FUNDS, Carnivore Quant Fund, raising and investing funds in any company or in any investments of the type contemplated by this information. The proposed operations are subject to all of the risks inherent in a new business enterprise. Past performance does not constitute future investment results.

Copyrights 2025 | PNTHR FUNDS™